Divorce Financial Forecast

How will divorce impact your financial future?

A Financial Forecast may be a good fit if you are:

Age 50+ and your post-divorce financial plan will depend on the spousal support and assets that you receive in the settlement.

Considering one or two settlement scenarios and would benefit from an analysis completed by a CERTIFIED FINANCIAL PLANNER™ Professional.

Wondering if it’s smart to keep the house.

In a divorce mediation or Collaborative Divorce and would like insight from a Collaboratively-trained financial advisor.

In a divorce mediation or Collaborative Divorce and you have “homework” from a session to speak to a financial advisor.

Wanting a one-time flat fee engagement with a financial advisor.

My focus had been raising my kids and supporting my spouse. I need a clear picture of how divorce will impact my future.

I really want to keep the house, but the trade-off is that I will get less brokerage and less retirement. I’m worried that keeping the house will jeopardize my long-term financial security.

I don’t have a high-paying career to fall back on. What I get in the settlement will pretty much be what I have going forward. Will it be enough?

I want to make smart financial decisions so I don’t regret my choices 10 or 20 years down the road.

How might a Financial Forecast benefit you?

Joan was 55 and getting divorced after a 30-year marriage. They were doing a Collaborative Divorce and Joan was trying to decide whether to keep the house. The Financial Forecast showed that if she kept the house, she would begin to run out of investment assets to live off of sometime in her early 70s. While Social Security would help, her plans for retirement would require large draws from her investments every year, and there was a high probability that her money would run out. In Joan’s situation, it made sense to sell the house and receive half the cash proceeds. Not keeping the house also meant she would get 50% of her spouse’s retirement accounts.

Karen was considering a settlement with a tiered spousal support schedule, where she would receive $7,500/month for three years and then $5,000/month for the next five years. Karen worked part-time. While she would need some of the support to make ends meet, she also knew that she could probably save some of it if she cut back on her expenses. Her Financial Forecast showed that if Karen could increase her savings by $1,200/month for the next eight years, she would likely be able to retire from her job two years earlier than she had originally planned.

Jamie was in a divorce mediation. The biggest assets to figure out were a Fidelity brokerage account and her spouse’s Rollover IRA. During our two-hour meeting, we discussed the differences between these two accounts, including the rules for taking distributions and the taxes owed. While her spouse had been pushing for each person to keep one account, the Financial Forecast showed the benefits of splitting each account 50/50. We also used our meeting time to discuss Jamie’s Social Security divorced spouse benefit.

Garrett was five years away from retirement when his spouse asked for a divorce. Garrett had been planning for a retirement filled with travel. The Financial Forecast confirmed that if he received at least 50% of the assets, he would still to be able to afford the retirement of his dreams, even if he didn’t receive spousal support. Knowing this took a lot of the pressure off the negotiations. At the next Collaborative Divorce team meeting, Garrett confidently agreed to a property division scenario.

Frequently Asked Questions.

How much does this service cost?

This service costs $800. This includes the creation of your Financial Forecast, plus a two-hour meeting to review the results and answer your questions. After our meeting, you’ll receive a copy of your financial report to keep for your records.

If you’d like additional time for further analysis, updates, or follow-up discussions, that time is billed at $325 per hour.

What do I get in a Financial Forecast?

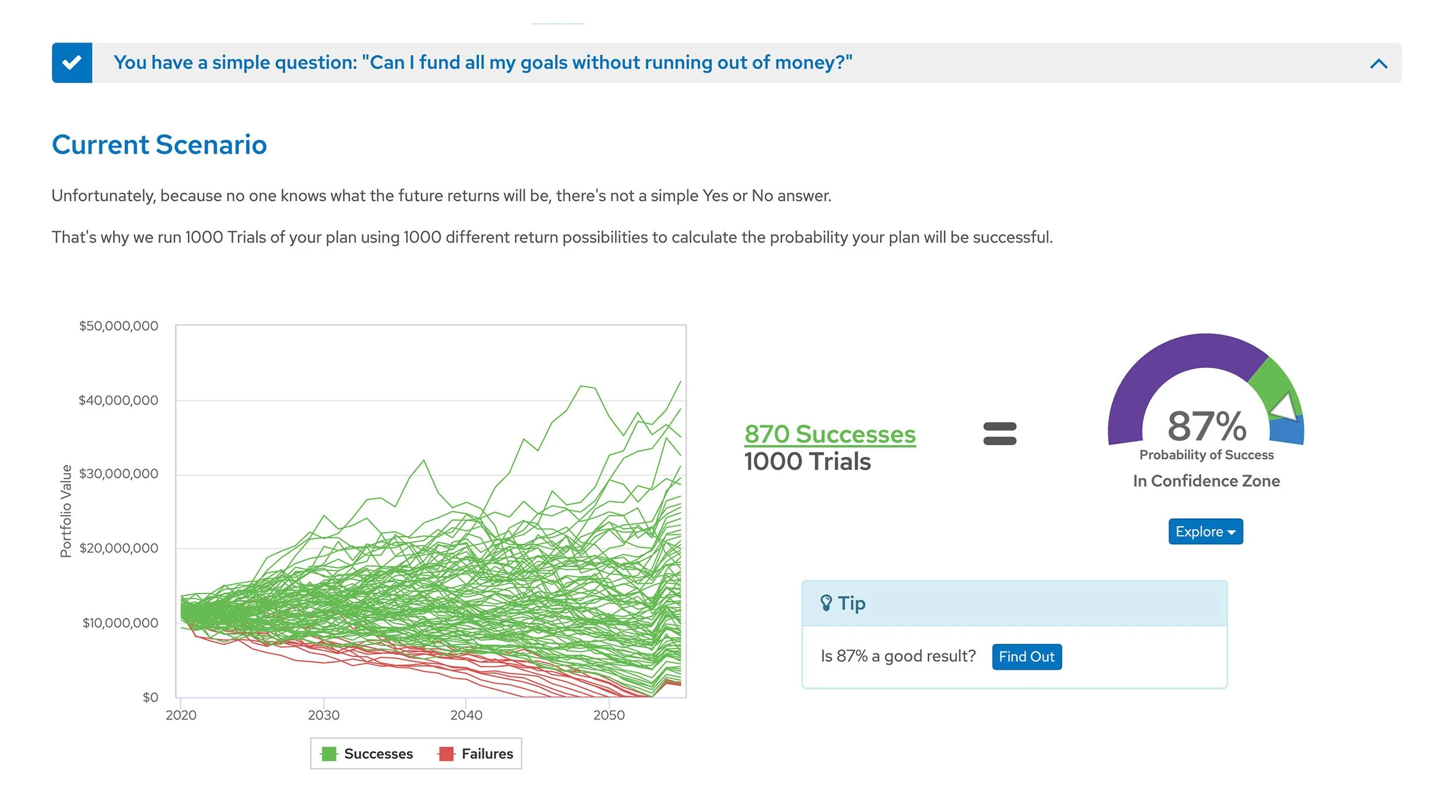

This service is designed to give you insight into how your settlement will impact your financial plans for the future. First, we collect key information, including details about the proposed settlement, your income, and your monthly expenses. Using financial planning software, we model what your financial future may look like. In particular, the software produces a probability that indicates the likelihood of running out of money.

Once the forecast is complete, we meet for a two-hour Zoom session to review the results. During this meeting, we walk through the numbers, look at “what if” scenarios, and answer your questions. Our goal is to help you understand your options, assess the trade-offs of different settlement scenarios, and feel empowered to make informed choices. After this meeting, we will send you a report with results.

Will I get a written report that I can share with my attorney?

Yes.

Can my attorney attend the two-hour financial meeting?

Yes.

What variables go into the analysis?

Below is a non-exhaustive list of factors considered in the Financial Forecast:

Property received in the settlement

Amount and duration of support

Annual savings rate

Annual spending (categorized as Essential Needs, Health and Medical, and Fun)

Large one-off expenses, such as buying a house or car

Age at retirement

Variations in rates of investment returns

Social Security income

Lifespan

How is this different from a net worth projection?

Depending on your divorce process, there may be a professional who generates a net worth projection. A net worth projection estimates what a property division settlement may be worth in the future. This type of analysis assumes linear rates of return. For example, the projection might assume that a brokerage account grows 7% in value every year. This simplified, straight-line view of your financial trajectory doesn't account for variations in investment returns or variations in your future spending needs. A net worth projection also does not factor in year-to-year differences in your annual savings rate.

Our Financial Forecast goes beyond basic projections. We use Monte Carlo-based financial planning software to evaluate the sustainability of your financial plan for the future. A Monte Carlo runs your plan many times, each time using a different sequence of investment returns. The result is a probability-based view of your ability to maintain your lifestyle after the divorce, even in less favorable market conditions. In addition, our software can model the impact of one-time expenses as well as year-to-year fluctuations in spending and savings.

My divorce is contested. Is a Financial Forecast a good fit for me?

Maybe. The Financial Forecast is a one-time engagement, which is how we are able to offer this service at a flat cost. We find that many clients in contested divorces need ongoing support from their financial professional. If you anticipate needing ongoing support, then this service may not be a good fit for your needs. However, we may instead be able to support you via an hourly engagement. Please reach out so we can learn more about your situation and where we may be able to add value.

My divorce is going to court. Is a Financial Forecast a good fit for me?

No. At this time, we are not taking engagements that require expert witness testimony. If your case is going to court, we recommend that you hire a financial professional who can testify as an expert witness.

Contact us to learn more.

In general, our services are best suited for individuals with $1 million or more in investable assets. If that aligns with your financial picture, we’d be happy to explore whether we’re a good fit for your situation.

Our $800 Financial Forecast service is available to all individuals, regardless of the size of their investment portfolio.